I. Introduction

Taxes can seem intimidating for digital nomads, and it’s no wonder. You’re earning money in different corners of the world, you might carry multiple currencies, and you’re not tied to a single country’s office or address. It’s easy to see how confusion takes root. But paying taxes as a nomad doesn’t have to be a nerve-racking ordeal.

In this article, we’ll walk through the fundamentals of nomadic taxes—how to figure out your tax obligations, what “tax residency” actually means, and which legal strategies can help you save money. We’ll also show you where to find official resources for both your home country and the place(s) you roam. By the end, you’ll have a better grasp on staying compliant without sacrificing your adventurous lifestyle.

Disclaimer: This guide is for general informational purposes. We are not tax attorneys or CPAs. Always consult a qualified professional for personalized advice.

II. Digital Nomads & Taxes: The Basics

A. Why Taxation Gets Complicated

When you live in one country, get paid by an employer in that same country, and file a straightforward tax return, life is pretty simple. But as a digital nomad:

- You might earn money from a client or employer in your home country while residing in another nation for half the year.

- You could be juggling multiple freelance gigs or remote positions across different time zones.

- You might cross various borders, each with its own set of tax rules or residency requirements.

This patchwork of global income sources and geographic mobility means your tax situation can get more complex than a standard single-country arrangement.

B. Key Tax Terms Every Nomad Should Know

- Tax Residency: The country (or countries) where you’re legally considered a tax resident. Each nation has its own rules for establishing residency, often based on how many days you spend there, or your permanent ties.

- Double Taxation: This means you pay taxes on the same income in two different places. Many countries have treaties to help you avoid this scenario, but it’s important to know how they work.

- Tax Treaties: Agreements between countries that define how taxes should be handled when you have connections to both. These can prevent (or at least reduce) double taxation.

- Foreign Earned Income Exclusion (FEIE): A U.S.-specific rule that allows certain Americans working abroad to exclude a chunk of their income from U.S. taxes, provided they meet specific requirements.

- Tax Domicile: Your permanent home base or the place you plan to return to when traveling ends. In some countries, domicile affects inheritance taxes or other special regulations.

III. Determining Your Tax Residency

A. What Is Tax Residency?

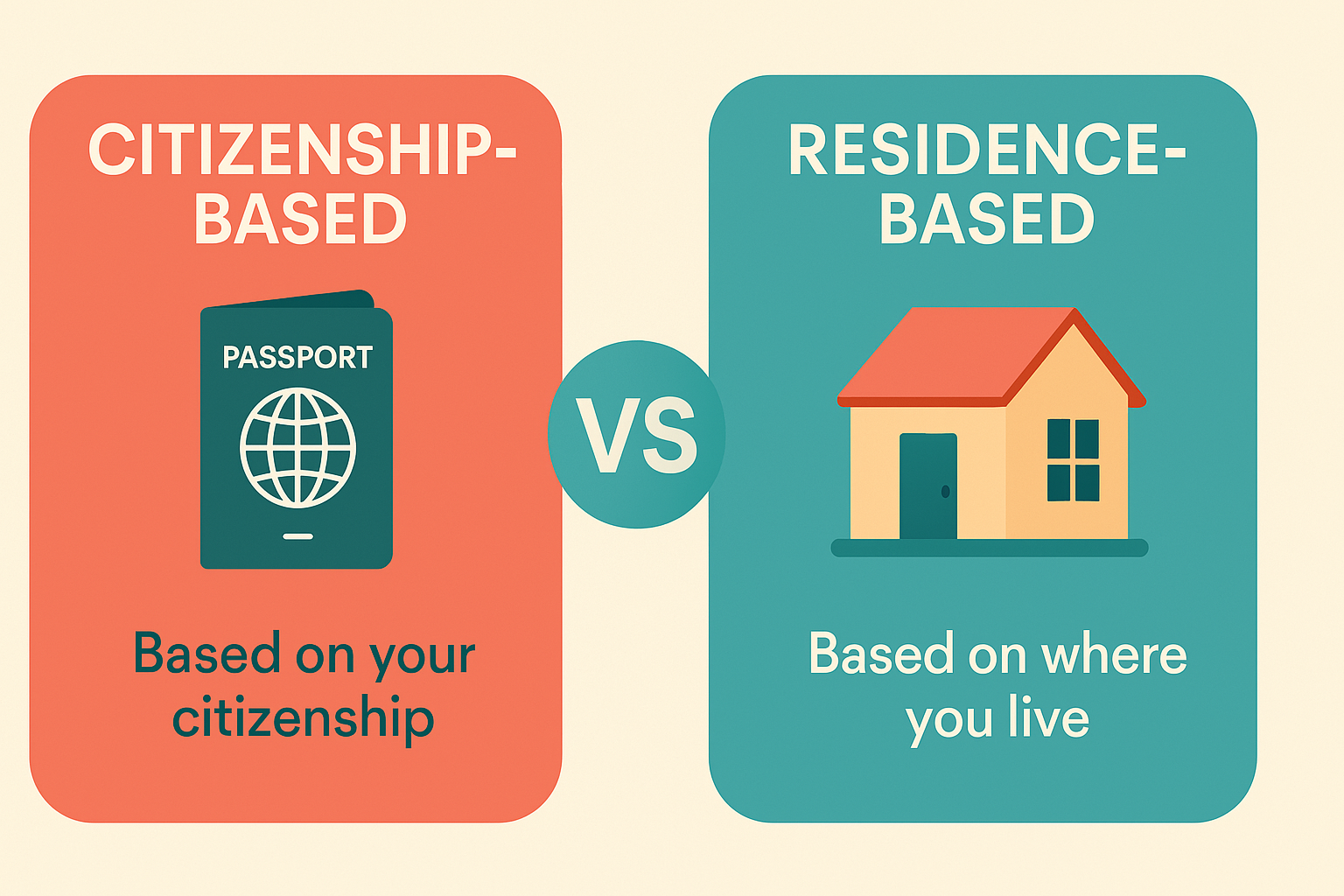

Tax residency is not necessarily the same as citizenship. You can be a citizen of one country but a tax resident of another if you meet its residency criteria. Many places use a “183-day rule” to figure out if you’re a resident for that tax year (spend more than half the year there, and you often become a tax resident).

Some countries define residency by center of life or permanent home: if your family, property, or main business ties are there, you might be considered resident regardless of the 183 days.

B. Avoiding Unintended Tax Residency

If you’re hopping from place to place, it’s possible to accidentally stay long enough to trigger tax residency. For instance, let’s say you love Spain’s coast so much you extend your Airbnb for seven months. Spain might consider you a tax resident if you cross certain day-count thresholds (unless you’re on a specific digital nomad visa that changes the rules).

To avoid a surprise tax bill:

- Track your days in each country.

- Check each country’s official immigration and tax websites.

- Be mindful of how “continuous” your stay is, especially if you’re approaching that 183-day mark.

IV. Understanding Tax Obligations as a Digital Nomad

A. Taxes in Your Home Country

Different countries handle taxes differently:

- Citizenship-based taxation: The United States is famous for this. If you’re a U.S. citizen or Green Card holder, you generally owe taxes on your worldwide income, no matter where you live. You can use strategies like the Foreign Earned Income Exclusion (FEIE) and Foreign Tax Credit to reduce or eliminate double taxation. For more details, visit the IRS International Taxpayers page.

- Residence-based taxation: Nations like the UK, Canada, Australia, and many in the EU typically tax residents on worldwide income, but non-residents or partial-year residents might be taxed differently. If you become a non-resident in these places, you usually have to prove strong ties to another country.

B. Taxes in the Country You’re Visiting

For short-term trips (e.g., a month or two), you’re likely just on a tourist status, so local taxation doesn’t often apply (unless you do local contract work). But for longer stays or official digital nomad visas, you might:

- Be exempt from local taxes if the visa specifically states so.

- Need to pay local taxes if your presence surpasses certain thresholds.

Always check official websites—like the national tax authority or immigration office—to confirm. Here are some direct links:

V. Tax Strategies & Benefits for Digital Nomads

A. Foreign Earned Income Exclusion (FEIE)

If you’re a U.S. citizen living and working abroad, you might qualify to exclude a certain amount (over $100,000 USD per year) of earned income from U.S. taxes, as long as you:

- Pass the Physical Presence Test (330 full days outside the U.S. in a 12-month period) or

- Prove Bona Fide Residence in another country.

For the latest FEIE details, see the IRS FEIE section.

This doesn’t necessarily eliminate state taxes unless you’ve given up residency in a particular state. You still need to file a federal return, but you can reduce the amount subject to tax.

B. Tax Treaties & Double Taxation Agreements

Many countries have tax treaties with each other. These pacts define which country gets to tax which portion of your income, or allow you to claim a credit for taxes paid elsewhere.

- Example: If you’re a Canadian living in France, the Canada-France tax treaty might help you avoid paying income tax in both countries.

- What to Do: Look up the official treaty text or consult a tax advisor for specifics. In the U.S., the IRS maintains a list of Tax Treaty Documents.

C. Tax-Friendly Countries for Nomads

Certain places aim to attract remote workers with lower tax rates or simpler rules:

- Portugal’s NHR (Non-Habitual Resident) program: Offers beneficial tax treatment for foreign income for up to 10 years. Learn more at the Portal das Finanças (official Portuguese tax portal).

- Georgia: Some foreigners can pay a flat tax or even zero if under specific conditions. Official info at the Revenue Service of Georgia.

- Dubai (UAE): Known for zero personal income tax, though you must meet residency or visa requirements. Government details at the U.AE Taxation Page.

Always read the fine print; some deals come with conditions (like investing in property or spending a minimum number of days in the country).

VI. Practical Steps: How to Pay Taxes as a Digital Nomad

A. Track Your Income and Expenses Carefully

Paper trails are your friend. Keep consistent records so you can:

- See exactly how much you earned each year.

- Deduct legitimate business expenses (e.g., software subscriptions, coworking space fees, travel costs for business purposes).

- Document your location if you’re claiming location-based exclusions.

Recommended Tools (with affiliate link placeholders):

- QuickBooks Self-Employed ([affiliate link placeholder])

- FreshBooks ([affiliate link placeholder])

- Xero ([affiliate link placeholder])

- Expensify ([affiliate link placeholder])

(All of these platforms help you track income, expenses, and invoices for seamless bookkeeping.)

B. Understand Filing Deadlines & Requirements

Different countries have different tax deadlines. The U.S. typically requires you to file by April 15, but if you’re abroad on that date, you often get an automatic extension to June 15 (with interest possibly accruing on any taxes owed).

- Mark your calendar with key dates for each relevant country.

- If you owe taxes in multiple places, consider a spreadsheet or digital reminder system to keep it all straight.

C. Decide If You Need Professional Help

Complexity is the main reason to hire a pro. If you only do a handful of remote gigs and are from a straightforward tax system, you might manage on your own. But if you:

- Have multiple income streams (e.g., e-commerce, freelance writing, consulting)

- Move countries more than once a year

- Have investments, rentals, or crypto earnings

then a specialized accountant or tax advisor is worth the cost. Some firms cater specifically to digital nomads, assisting with multi-country obligations, FEIE, or tax treaties. For example:

- Nomad Tax ([affiliate link placeholder])

- Expat Tax Online ([affiliate link placeholder])

D. How to Actually File Your Taxes Abroad

Most modern tax authorities allow online filing. For example, the IRS’s e-File system or commercial software is standard for U.S. taxes. The UK’s HMRC Self Assessment portal is also user-friendly.

- If you can’t file online, you may mail paper returns to the relevant tax office or sign over power of attorney to an authorized representative.

- Confirm the official instructions for each country to avoid last-minute chaos.

VII. Common Mistakes Digital Nomads Make (and How to Avoid Them)

A. Ignoring Taxes Altogether

It’s tempting to think “if I’m never in my home country, I don’t owe anything.” That’s often incorrect. Many countries expect you to file a return even if you think you owe $0. Neglecting this can lead to penalties, fines, or trouble re-entering the country.

B. Misunderstanding Residency & Income Rules

For instance, you might qualify as a tax resident in a new country because you spent more time there than planned. If you didn’t realize it, you might end up with an unexpected local tax bill.

Solution: Keep a day-count diary or use apps that track your location. Consult official sources or a tax pro when in doubt.

C. Failing to Report International Bank Accounts

If you’re a U.S. citizen, you may need to file an FBAR (Foreign Bank Account Report) if your foreign accounts total more than $10,000 at any point in the year. Other countries have similar requirements. Penalties for non-compliance can be huge.

D. Late Filing & Payment

Missing deadlines, even by a few days, can rack up penalties. Some countries are lenient if you’re a first-time offender, but it’s never guaranteed.

E. Overpaying or Underpaying Estimated Taxes

If you’re self-employed, you might need to pay quarterly estimates instead of one big chunk at year-end. Underpaying can incur fines, while overpaying ties up your cash.

VIII. Special Situations & FAQs

- Can I legally avoid paying taxes as a digital nomad?

Not entirely. While you can reduce your tax burden through exclusions and treaties, almost every country expects some form of filing and/or payment. Attempting to vanish entirely can lead to severe consequences. - What if I never stay longer than 90 days in any country?

You’ll likely maintain a tax filing obligation in your home country (especially if you’re a U.S. citizen). Short tourist stays usually don’t trigger local tax residency, but verify day-count rules for each place. - How do cryptocurrency earnings factor into taxes as a nomad?

Crypto gains are typically taxed similarly to other capital gains. Some places (like Portugal, under certain conditions) offer favorable crypto tax treatment. Still, you’ll need to track buy/sell dates, cost basis, and gains. - What happens if I missed filing taxes for several years?

You may face penalties or interest, but many countries have “voluntary disclosure” options that reduce fines if you come forward first. Seek professional advice. - Do digital nomad visas come with special tax rules?

Some do (like reduced tax for certain durations). Others only address residency rights, not tax obligations. Read the fine print of each program or consult local authorities.

IX. Real-Life Examples

- Case Study: Maria

A U.S. freelance web designer spent half the year in Bali and the other half traveling across Europe. She filed a U.S. tax return, claiming the FEIE for her Bali months. She carefully tracked her travel days using a calendar app, ensuring she qualified for the physical presence test. By doing so, she avoided double taxation on most of her income. - Case Study: Luka

A Canadian digital marketer who relocated to Portugal used the Non-Habitual Resident (NHR) program. He still filed a partial return in Canada the first year he left, establishing non-resident status. In Portugal, he had reduced tax on foreign-sourced income for a set period. By talking to a cross-border accountant, he avoided paying taxes twice.

X. Recommended Resources & Tools

- Official Tax Websites:

- Accounting & Bookkeeping Software ([affiliate link placeholders]):

- Expense Tracking Apps:

- International Tax Consultants ([affiliate link placeholder]):

XI. Conclusion & Action Steps

Paying taxes as a digital nomad doesn’t have to be a mystery. By pinning down your tax residency, using legitimate breaks like the Foreign Earned Income Exclusion or tax treaties, and staying organized with your documents and deadlines, you can protect yourself from nasty surprises.

Just remember:

- Stay Informed: Tax laws can change, so always check official resources.

- Keep Good Records: Track income, expenses, and travel days.

- Use Treaties & Exclusions: Don’t miss out on legal ways to reduce double taxation.

- Know When to Hire Help: A good accountant can save you both time and money if things get complicated.

Next Steps:

- Compare your current country’s tax rules to those of your home country. Are you inadvertently triggering residency somewhere else?

- Check out our Best Countries with Digital Nomad Visas for Long-Term Remote Work to see if there’s a tax-friendly option that suits you.

- If you’re a U.S. citizen, explore the Foreign Earned Income Exclusion (FEIE) in more detail on the IRS website.

Your nomad journey shouldn’t be overshadowed by fear of the tax man. Once you know your obligations and set a system in place, you’ll have more time and peace of mind to do what you set out to do—work remotely from inspiring places, connect with new cultures, and enjoy the freedom of a location-independent life.

Affiliate Disclosure: Some of the links in this article may be affiliate links, meaning we could earn a small commission—at no extra cost to you—if you decide to purchase or sign up. This helps us continue creating helpful resources for the nomad community.